Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today.

Manage and Pay Your Bills Online

https://www.paypal.com/us/digital-wallet/manage-money/pay-bills

PayPal is a convenient and secure way to manage your bills. With PayPal, you can link, pay, and manage your bills from the PayPal app or website. In this guide, we will explore how to pay your bills using PayPal, the benefits of using PayPal for bill pay, and answer some frequently asked questions.

How to Pay Your Bills with PayPal

Paying your bills with PayPal is easy and straightforward. Here’s a step-by-step guide on how to get started:

- Open the PayPal app or log in to your PayPal account on the website.

- Click on the “Pay Your First Bill” button.

- Search for your biller, and select it from the search results. If your biller doesn’t appear in the search results, try typing the biller’s full name or using more precise keywords.

- Enter your bill account details, such as your account number and biller’s information.

- Click “Add Your Bill” to link your biller to your PayPal account.

- Choose a payment method, such as a bank account, debit or credit card, PayPal balance, or PayPal Credit.

- Confirm your payment details and click “Pay” to complete the transaction.

Benefits of Using PayPal for Bill Pay

There are several benefits to using PayPal for bill pay:

- Convenience: PayPal allows you to manage all your bills in one place, making it easy to keep track of your payments and due dates.

- Security: PayPal doesn’t share your full financial information, so you can pay your bills securely without worrying about your sensitive information being compromised.

- Ease of use: PayPal allows you to set up recurring payments, so you don’t have to worry about forgetting to pay your bills on time.

- Rewards: Some billers offer rewards, such as cash back, points, or miles, when you pay your bills using PayPal.

Frequently Asked Questions

Here are some frequently asked questions about PayPal bill pay:

- Can I pay my bills with PayPal?

Yes, you can link, pay, and manage your bills from the PayPal app or website. - What bills can I pay with PayPal?

You can pay a variety of bills using PayPal, such as power, water, cell phone, subscription services, and more. - Why can bills show as unpaid or overdue if they’re paid through another channel?

When you pay your bill using a different method other than PayPal, it can take some time to reach PayPal’s system. Once your payment posts in the PayPal network, the bill will show as “paid” and you can disregard the overdue notice. - Why can there be late fees when I pay my bill on time?

Some billers may not consider your bill paid until 5 days after you paid it. Depending on the biller, sometimes it can be credited right away. If you’re charged a late fee, contact your biller to request a correction or late fee refund.

Conclusion

PayPal bill pay is a convenient and secure way to manage your bills. With its ease of use, security, and rewards, it’s no wonder why millions of people use PayPal for their bill pay needs. By following the steps outlined in this guide, you can start paying your bills with PayPal today.

Yes. You can use PayPal to link, pay, and manage your bills from the PayPal app or the PayPal website. For more information on Bill Pay, please see our user

Can I pay my bills with PayPal?

FAQ

How does bill pay work on PayPal?

- Go to your Dashboard.

- Click More near the top right of the screen.

- Click Pay your bills.

- Click Pay next to the biller’s name.

- Review the bill details and click Pay.

- If prompted, enter the payment amount, and click Next.

- Select your payment method and payment date.

How do you bill on PayPal?

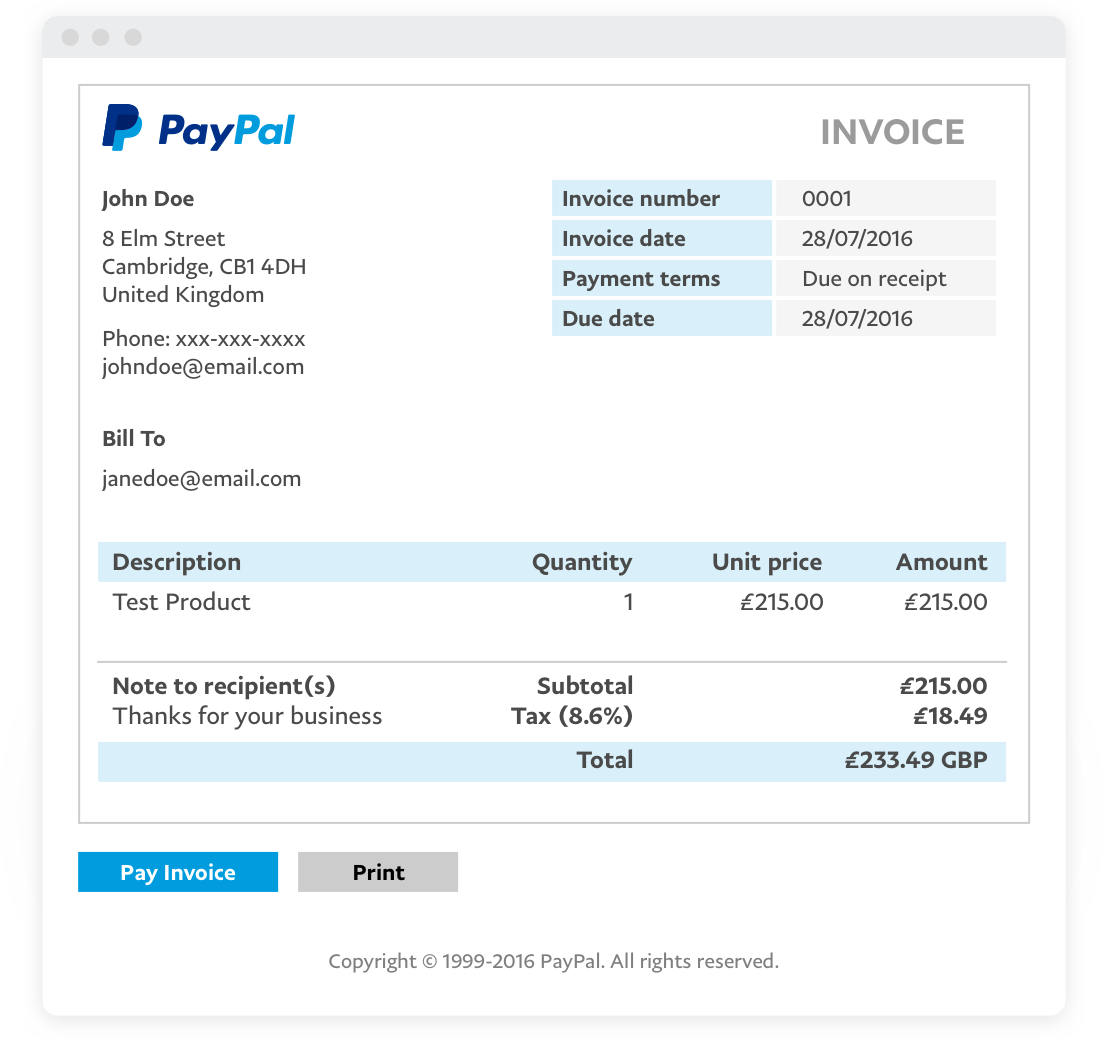

- Create your invoice. Select Create Invoice and enter information for customer, items, price, due date, or any other terms.

- Preview and send. Preview your invoice and then send it immediately or schedule it for later.

- Get paid.

Can I use PayPal credit to send money to myself?

Can I pay mortgage with PayPal?