Plans starting at $30 per month. Step 2. Sign up for Bill Pay.

Online Bill Pay

https://quickbooks.intuit.com/bill-pay/

Looking for a convenient and efficient way to manage your business payments? Look no further than QuickBooks Bill Pay! With this innovative solution, you can streamline your accounts payable process, save time and money, and enjoy a host of benefits designed to help your business thrive.

In this article, we’ll explore the ins and outs of QuickBooks Bill Pay, including its features, pricing, and setup process. We’ll also discuss how it can help your business simplify its payment processes and improve your financial workflow.

What is QuickBooks Bill Pay?

QuickBooks Bill Pay is a payment solution designed specifically for small businesses. It allows you to pay your vendors and contractors quickly and easily, without the need for paper checks or manual bank transfers. With QuickBooks Bill Pay, you can:

- Pay bills online or through the QuickBooks mobile app

- Schedule recurring payments in advance

- Set up automatic payments for regular bills

- Track and manage your payments in one place

- Take advantage of discounts for early payment

How Does QuickBooks Bill Pay Work?

QuickBooks Bill Pay works by connecting your QuickBooks account to your bank account. Once connected, you can easily pay your vendors and contractors using the QuickBooks platform. You can choose to pay by bank transfer, credit card, or paper check.

Here’s a step-by-step overview of how QuickBooks Bill Pay works:

- Sign up for QuickBooks Bill Pay: To get started, sign up for QuickBooks Online and choose the Bill Pay option.

- Connect your bank account: Link your bank account to QuickBooks by providing your bank’s routing number and account number.

- Add vendors: Enter your vendors’ information, including their name, address, and payment terms.

- Create bills: QuickBooks will automatically create bills for you based on the invoices you receive from your vendors.

- Review and approve bills: Review the bills created by QuickBooks and approve them for payment.

- Choose a payment method: Select how you want to pay your vendors, such as by bank transfer, credit card, or paper check.

- Schedule payments: Choose when you want to pay your vendors, such as immediately or on a future date.

- Track payments: Keep track of your payments in QuickBooks, including the date paid, amount paid, and payment method.

Benefits of QuickBooks Bill Pay

QuickBooks Bill Pay offers a range of benefits that can help your business streamline its payment processes and improve your financial workflow. Some of the key benefits include:

- Convenience: Pay your vendors and contractors quickly and easily, without the need for paper checks or manual bank transfers.

- Time-saving: Save time by automating your payment processes, allowing you to focus on other areas of your business.

- Accuracy: Reduce errors by automatically matching payments to invoices, ensuring that you pay the correct amount.

- Discounts: Take advantage of discounts for early payment, helping you save money on your vendor invoices.

- Visibility: Keep track of your payments in one place, making it easier to manage your cash flow and make informed financial decisions.

Pricing and Plans

QuickBooks Bill Pay offers a range of plans to suit your business needs, with pricing starting at $30 per month. Here’s an overview of the plans and pricing:

- Basic: $30 per month (5 free ACH payments, $0.50 per transaction thereafter)

- Premium: $7.50 per month (50 free ACH payments, $0.50 per transaction thereafter)

- Elite: $45 per month (Unlimited ACH payments, $0.50 per transaction thereafter)

Setup and Integration

Setting up QuickBooks Bill Pay is easy and straightforward. Here’s a step-by-step

Sep 13, 2023 — Sign in to your QuickBooks Online company file. · Select Get paid & pay, then Bills. · Create a new bill or select an existing unpaid bill.

QuickBooks Bill Pay explained: How it works, benefits, and setup

FAQ

How does bill pay work in QuickBooks?

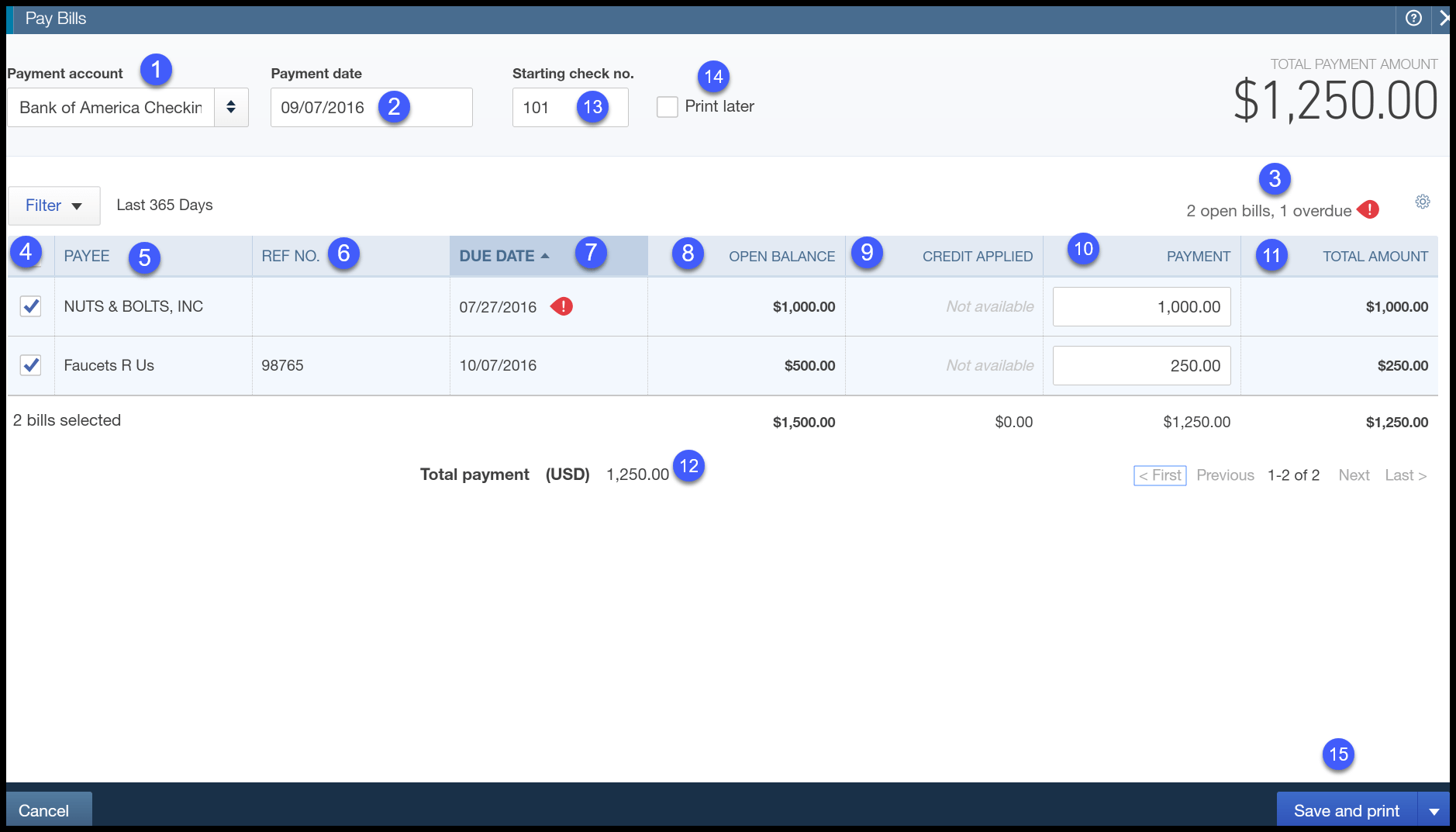

- From the Vendors menu, select Pay Bills.

- Select the bill(s) to pay.

- Set any discount or credits that you want to apply.

- From the Account dropdown, choose the checking account with the online vendor payment service.

- From the Method dropdown, choose Online Bank Pmt.

Does QuickBooks bill pay cost money?

What is the difference between QuickBooks bill pay and bill com?

Which QuickBooks has bill pay?