Get QuickBooks Online Plans starting at $30 per month. Step 2. Sign up for Bill Pay.

Online Bill Pay

https://quickbooks.intuit.com/bill-pay/

Managing business payments can be a daunting task, especially when it comes to keeping track of various vendor invoices, contractors, and payment schedules. This is where QuickBooks Online Bill Pay comes in, a feature-rich solution that simplifies the payment process, saving you time and effort. In this article, we’ll explore the benefits of using QuickBooks Online Bill Pay and how it can help your business.

What is QuickBooks Online Bill Pay?

QuickBooks Online Bill Pay is a payment management solution designed for small businesses, mid-size businesses, and enterprises. It allows you to pay vendors and contractors quickly and efficiently, automate payment processes, and maintain a digital record of all transactions. With QuickBooks Online Bill Pay, you can say goodbye to manual data entry, lost invoices, and missed payments.

Benefits of Using QuickBooks Online Bill Pay

1. Automated Payment Processing

QuickBooks Online Bill Pay automates the payment processing for you, ensuring that your vendors and contractors receive payments on time, every time. You can schedule payments in advance, set up recurring payments, and even create templates for frequently used vendors. This feature eliminates the need for manual data entry and minimizes the risk of errors.

2. Digital Record Keeping

Keeping track of paper invoices and payments can be a nightmare, especially during tax season. QuickBooks Online Bill Pay solves this problem by maintaining a digital record of all transactions. You can easily access payment history, invoices, and receipts in one place, making it easier to manage your finances and prepare for tax time.

3. Customizable Workflows

QuickBooks Online Bill Pay allows you to tailor your payment workflows to suit your business needs. You can create custom roles and permissions, assign specific tasks to team members, and set up approval processes to ensure that payments are accurate and authorized. This feature helps you maintain control over your business finances and ensures that everything is documented and traceable.

4. Cost Savings

Using QuickBooks Online Bill Pay can help you save money on transaction fees. With the Basic plan, you get 5 free ACH payments per month, and the Premium plan offers 40 free ACH payments per month. Additionally, you can save up to 50% on check payments compared to traditional bank checks.

5. Integration with QuickBooks Online

QuickBooks Online Bill Pay seamlessly integrates with QuickBooks Online, allowing you to manage your finances and payments in one place. You can easily import invoices, track expenses, and generate reports to gain insights into your business’s financial health.

How to Get Started with QuickBooks Online Bill Pay

Getting started with QuickBooks Online Bill Pay is easy. Here’s a step-by-step guide to help you set up your account:

- Sign up for QuickBooks Online: If you haven’t already, sign up for QuickBooks Online. Choose the plan that best suits your business needs.

- Add QuickBooks Bill Pay: Once you’re signed up for QuickBooks Online, you can add QuickBooks Bill Pay to your account. Navigate to the “Account & Settings” section and select “Bill Pay” from the list of available features.

- Set up your payment method: You’ll need to set up a payment method to fund your Bill Pay account. You can link a bank account, use a credit card, or set up ACH payments.

- Invite vendors and contractors: You can invite your vendors and contractors to sign up for QuickBooks Bill Pay, making it easier for them to receive payments.

- **Start paying b

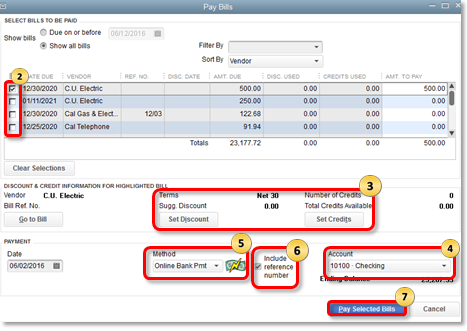

Schedule bill payments with QuickBooks Bill Pay · Sign in to your QuickBooks Online company file. · Select Expenses, then Bills (Take me there). · Create a new

Learn about QuickBooks Bill Pay

FAQ

How does QuickBooks Online bill pay work?

Does QuickBooks Online have a bill pay option?

How much does online bill pay cost in QuickBooks Online?

What is the difference between QuickBooks Online bill pay and bill com?