CUSTOMER PORTAL SIGN IN. Make payments, see account details and more!

Credit Acceptance: Login

https://customer.creditacceptance.com/

If you’re a customer of Credit Acceptance, you may be wondering how to make a payment on your account. Look no further! This guide will walk you through the various ways you can make a payment, including online, by phone, and by mail. We’ll also cover some frequently asked questions about Credit Acceptance bill pay.

Online Payments

The easiest and most convenient way to make a payment on your Credit Acceptance account is online. Simply log in to your account on the Credit Acceptance website, click on the “Make a Payment” button, and follow the prompts to enter your payment information. You can make a one-time payment or set up recurring payments to ensure that your account is always up to date.

Phone Payments

If you prefer to make a payment over the phone, you can call Credit Acceptance’s customer service line at 1.800.634.1506. Have your account number and payment information ready, and follow the prompts to make your payment.

Mail Payments

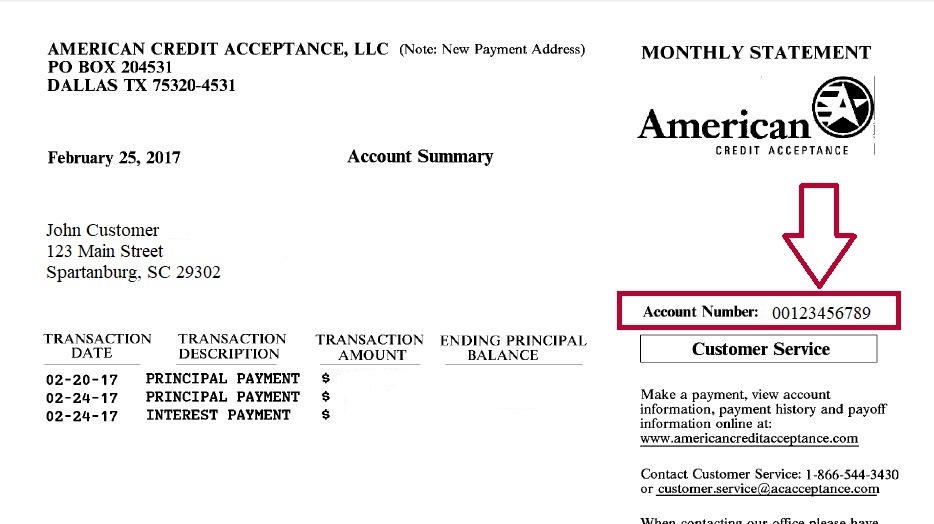

If you prefer to pay by mail, you can send a check or money order to Credit Acceptance’s payment address:

Credit Acceptance

P.O. Box 5555

Southfield, MI 48034

Be sure to include your account number and the payment coupon from your statement, and allow 7-10 business days for your payment to be processed.

Frequently Asked Questions

Here are some common questions that Credit Acceptance customers may have about making payments:

- Q: Can I make a partial payment on my account?

A: Yes, you can make a partial payment on your Credit Acceptance account. However, keep in mind that you will still be charged interest on the remaining balance until it is paid in full. - Q: Can I pay my Credit Acceptance bill with a credit card?

A: No, Credit Acceptance does not accept credit card payments. You can only make payments using a checking or savings account. - Q: How long does it take for my payment to be processed?

A: Online payments are processed immediately, while phone and mail payments may take 7-10 business days to be processed. - Q: Can I set up automatic payments on my Credit Acceptance account?

A: Yes, you can set up recurring payments on your Credit Acceptance account to ensure that your payments are always on time.

Conclusion

Making a payment on your Credit Acceptance account is easy and convenient, with options for online, phone, and mail payments. Remember to always have your account number and payment information ready, and allow 7-10 business days for your payment to be processed. If you have any questions or concerns, don’t hesitate to contact Credit Acceptance’s customer service line for assistance.

Our monthly payment and auto price calculators can help you estimate a monthly payment or the purchase price of a vehicle that fits your budget. Learn More.

FAQ

What are the payment methods for Credit Acceptance?

Why is Credit Acceptance getting sued?

Does Credit Acceptance put trackers on cars?

How late can you be on a car payment American Credit acceptance?